In the changing realm of finance, a fresh contender has emerged that could reshape the industry: fintech, also known as technology. It is a breakthrough area which fuses financial services with technology so as to offer affordable, simple to access and convenient solutions. Fintech development companies are driving this transformation process and they are using their strategies. This article takes a detailed look at how fintech develops so as to reveal the intricacies involved in this process.

The Evolution of Fintech

Indeed, the story of innovation and adaptation in the fintech space makes for a fascinating read, revealing how technology can shake up ancient sectors. The report encompasses several decades and narrates the growth of fintech from its infancy to present-day status on the world stage. This is one of the inspiring stories illustrating how technology alters not only the financial industry but the whole world in general. The development of electronic trading, the expansion of Internet banking, the increase and popularity of mobile money transfer solutions, and the use of modern techs such as blockchain and artificial intelligence are among these pivotal moments. The journey has shed light on new knowledge and prospects that have transformed the face of business as far as money matters are concerned while making access easier and more convenient. Technology has proven its capacity for creating innovations and altering the boundaries of what is imaginable in a financial industry by developing fintech.

Milestones in Fintech History

The progression of fintech commenced when plastic cards and automatic teller machines were debuted, marking the era of incorporating engineering into the sector. With the emergence of the world wide web and mobile technologies, this tendency accumulated momentum, guiding to the ascent of online banking, digital payments, and electronic purses. Every meaningful move in Fintech’s narrative not solely bettered prevailing benefits but also constructed them more obtainable to a broader array of individuals, thereby democratizing fiscal instruments for all.

Technological Innovations Shaping Fintech

The key success ingredients for fintech include its underlying technological backbones. For example, blockchain technology did not stop with cryptocurrency but improved payment processing and securely recorded information. Another pillar is Artificial Intelligence (AI) and Machine Learning (ML), which provide predictive analytics, fraud detection, and personalized financial advice. These are not mere supplementary features but critical components that underpin the efficiency and efficacy of modern fintech implementations.

Core Technologies Driving Fintech

The development and natural progression of the financial technology industry are closely tied to technological progress across various domains. Consider blockchain, for example, which transforms transaction security and visibility in a positive manner, or artificial intelligence and machine learning, pivotal in gleaning deep insights from data and crafting individualized user experiences. These technologies are fundamental to financial technology, playing a vital role in encouraging innovation, heightening operational efficiency, and redefining excellence in banking and investment services. This symbiotic relationship between technology and finance places financial technology at the forefront of modernized financial progress.

Blockchain in Fintech

Fintech’s transformative aspect is embodied by blockchain. Originally linked with Bitcoin and other cryptocurrencies, but this technology is finding numerous uses in all elements of fintech today. Being a decentralized system, it also offers a degree of transparency as well as security for both parties involved in the transaction. A derivative of blockchain, smart contracts are taking over traditional contract procedures; they eliminate the need for third parties and increase productivity.

The Role of AI and Machine Learning

Relationships between people and businesses are evolving due to technology developments in finance, artificial intelligence, and machine learning. New tools, like chat assistants for customer support inquiries and personalized financial recommendations created from analyzing individual spending patterns, represent innovative approaches to customer engagement. In addition, these innovations play a role in risk evaluation, fraud identification, and data administration, helping to ensure financial technology services are safer and deserve more confidence.

Strategic Frameworks in Fintech

Of all the considerations necessary for success of any financial technology initiative, it is crucial that businesses put into place strategic frameworks. These frameworks are used to lay out a map or a path for the innovation process, an act that serves as a navigation aid. This ensures that technology breakthroughs are not merely on theory level as they integrate into practical and appropriate solution in financial services. The main difference between fintech projects that work and those that do not work, lies in the translation of technology into tangible services. The strategic planning’s role is critical in linking the possibility of technology with financial application reality.

Embracing Agile and Lean Principles

Currently, fintech development is done using agile and lean practices. The techniques include being flexible, collecting feedback from customers, and continuous corrective action. They enhance speed of reaction to market trends, development of customer orientated products, and resource utilization efficiency for the fintech companies. An industry undergoing continual technological developments and ever-changing customer taste demands flexibility.

Customer-Centric Approach to Development

This approach ensures that the fintech develops based on the needs of customers for products like credit scores and loans. It focuses on making items and services that are tailored according to customer need. Customer-centric approach enables building loyalty towards products and customers’ involvement, making fintech companies stand out amidst fierce competitors.

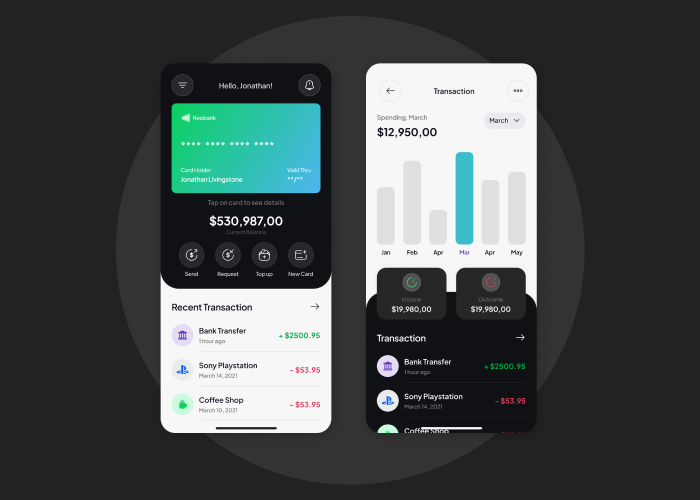

Neobank Software Development: A Case Study

For instance, in financial technology, there was a Neobank software development done by a firm that aims to make banking services easy to handle through internet. The goal of this project was to create an initially cheap prototype at the scale of 3-6 months as part of the strategic plans.

Challenges and Solutions

The first hurdle was quickly producing a prototype in response to tight deadlines and a limited budget. The approach involved several key steps:

- Prototype Development: The team identified the project boundary, established the architecture, chose the technology stack, and proposed a basic concept of design. They also collaborated with the business team on critical feature prioritization.

- Product Development: In this phase, the team engaged in talks and implementation of the main features and scalability for the fully fledged product. It focused on revamping the design and incorporating new capabilities and bridging all the gaps that were found in the initial draft.

- Platform Development: User feedback made it possible for the company to constantly improve the quality of its product. The strategies included scalability, integration, and continued maintenance of software.

Outcomes and Business Value

The first phase resulted in a feasible solution that was within timelines and budget thus helping to secure investments for future developments. A high quality solution was produced in subsequent phases that surpassed all product requirements and expectations. Engineers were instrumental in incorporating required capabilities for easy bank account handling as well as upgrades on customer service.

This success in the project made banking processes easier, efficient with less customers’ waiting time and ultimately led to high customer satisfaction and loyalty. To the company’s bottom line, this optimization showed the power of strategy development based on financial technologies.

Navigating Challenges in Fintech Development

However, fintech has a lot of promise and equally many complex issues. Mastering the labyrinth of regulatory compliance entails profound awareness and adeptness on dynamic legal grounds. Likewise, strong cyber security is also required to be vigilant in addition to being visionary. It is important for fintech companies to be thorough and develop strategies carefully so they can leverage on opportunities but also avoid risks, in this fast moving industry.

Overcoming Regulatory and Security Obstacles

It is often said that the biggest problem for fintech development companies is a maze of financial regulation. These regulations vary across different jurisdictions as they tend to change rather fast due to advancing of new technologies. On the other hand, compliance encompasses much more than merely following laws; it entails building trust among customers, investors, and others who are crucial in every organization. This involves cyber security as well. These are become victims of many cyber attacks, as there were more and more online financial services. This helps to assure consumers that fintech companies are spending their precious assets to safeguard confidential information.

Future Trends in Fintech

Fintech evolves very fast with time. With a broad space for innovative ideas, new trends can turn the whole market upside down. The evolving trends imply that financial services have been developed into new conceptions, constructions, and deliveries. Blockchain, a new technology for future fintech provides the promised higher level of security and transparency than any previously existed. Also there is AI and the machine learning that will personalize and simplify the financial service provision and delivery. Decentralized finance (DeFi) is challenging traditional banking models too, due to its convenient nature and openness. Decision making is now becoming more data driven with big data analytics. These models suggest that fintech will become an integral part of the global financial ecosystem, which is also indicative of more advanced and inclusive technological environment for financial transactions.

Decentralized Finance and Digital Currencies

One of the most interesting developments, which has emerged form the fintech industry, is the rise of decentralized finance (DeFi) and digital currencies. Here is where DeFi presents an alternate peer-to-peer, transparent, and accessible blockchain-based financial service without intermediaries. The world is starting to view CBDCs and other types of digital currencies as legal tender and how this changes our perception of money and exchange. These trends are not exclusively about technology and showcase a shift towards a more inclusive and inclusive financial system.

Conclusion

It’s an ongoing journey with constant innovation in fintech development. Nevertheless, the fintech development enterprises do not simply take part in the finance industry, they also transform it. These firms use modern technologies and strategic models to set standards of effectiveness, security and customers’ engagement. They will rewrite the history of finance as one that is inclusive, innovative, timely, in response to the emerging trends and solutions to emergent challenges in search for ways forward.